We’re back with what I’ve now decided will be a weekly blog until I ultimately don’t write weekly — more to come. I highly encourage you to stick around for the end, which includes yet another recap of the week that was in Delusional Prediction Market Twitter™️.

Bad Rules Are Also Sometimes Good Rules

Everything in life is 50/50, it either happens or it doesn’t, or, exchange-speak, it settles at 0¢ or 100¢. Until it doesn’t. As Chris Dierkes (@flupnolide) eloquently highlighted while definitely not on tilt and in since-deleted tweets, current settlement rules at Kalshi provide for a third outcome in which a market is settled by a different metric, last traded fair price. I would hate to bore my readers and know Chris plans to touch on this, so instead of suggesting that voiding relevant cases is optimal just take my word for now that it is not, in fact, practical.

Settling events at last traded fair price makes sense in many cases, specifically match outcomes. If Pirates/Cardinals is rained out, and knowing a void is not practical, settling the market at last traded fair price allows provides a means of contract settlement at prices in line with the fair market price of the outcome. This is equitable. The same goes for any match/tournament that is cancelled for a variety of economic, political, and weather-related reasons.

Market Manipulation for Dummies

None of the above applies to player props. Why does last-traded price not work for prop settlement? In short, timing, volume, and game theory.

The settlement source for NFL props at the moment is the league, which means an Ian Rapoport tweet confirming a player is out is entirely irrelevant with respect to settlement. “This is good; reporters are fallible!” True. “This is bad; the trading between social media confirmation and official publishing of inactives is now entirely detached from the probability of the event occurring” Also true.

We also get at a deeper issue in the above: Can the settlement source be different than the source used to determine timing of last traded fair price? For simplicity’s sake I will assume that it cannot in this article, as I cannot begin to fathom the disasters that would follow a “hindsight is 20/20” approach that assumes reporters are infallible when they are right, but ignores their inaccuracies when they are not. Moving on.

In practice this policy not only incentivizes market manipulation, it forces it. Outlined below is practical scenario depicting why.

We have a sizable position on Cole Kmet to record a touchdown in the Bears next game, with an average weighted cost of 16 cents. This game kicks off at 1pm.

At 7am, Ian Rapaport tweets that Kmet is questionable with an illness (price trades to 10c)

At 7:30am Adam Schefter reports that Kmet will not suit up due to illness.

What do you do? There are three options between the point at which Kmet is acknowledged to be out (7:30) and the period when the market will settle (11:30am). You can either a) sell at a loss, b) accept that the market will settle based on last traded fair price and will likely result in a loss, c) purchase more shares, benefitting your initial investment and driving further gains to the extent the last traded fair price is above your existing purchases. With two ways to lose and only one way to win, the rational choice is to manipulate the market — even though you know the player won’t participate.

To benefit from this scenario you must ensure last traded fair price at 11:30 does not dip below your purchase price. In essence, the worse you trade, the more you make. In the case of Kmet, you purchase all contracts available to 20 cents and offer continuous bids at the 21 cent threshold, ensuring profit despite a fair market value below all trades.

Market Manipulation For … Everyone

You are, of course, not the only person or entity holding contracts in this market. Every participant in this market is now faced with the same dilemma, same potential outcomes, and same decision tree. A large market maker, holding a significant NO position in the same market, must now provide sufficient liquidity to ensure the last traded fair price does not trade worse than their weighted cost. Both sides now have no choice but to keep adding liquidity, even though the market’s outcome has already been decided.

Is this market manipulation? Almost certainly — but it is rather impractical to assume that all parties forced by game theory to act in a congruent manner will choose to act against their own self-interest 100% of the time. It is also almost entirely unenforceable given the action, making markets, is the core product. Further, effective enforcement would likely only successfully target the market makers that are both the lifeblood of the exchange as well as, increasingly, the exchange itself.

Player props are uniquely susceptible to the perils of last traded price manipulation due to a unique confluence of relative illiquidity and event volatility. In other words, props (specifically NBA) are far more likely to end in a “no contest” due to injury/illness, and are also comparably illiquid due to the volume of props offered for a single slate. You are far more likely to have an opportunity to benefit from manipulation in a prop market, and it is comparably cheap to do so. These are less-than-ideal circumstances for unsuspecting retail traders partaking in such markets.

Bad Rules Can Be Bad For More Than One Reason

Last traded fair price settlement is almost guaranteed to asymmetrically impact the retail customer. At every regulated and unregulated sportsbook an event is either voided or paid out. Imagine a retail consumer sees significant “No” liquidity available for Cole Kmet touchdown after he has been ruled out. Thinking it’s a sure win they buy — not realizing the rules guarantee they will lose. Is it on the user for using a platform without fully understanding its terms, absolutely. Is it equally as likely to create a predatory experience that benefits sophisticated users to the detriment of unsophisticated users, absolutely. Any policy that provides incentive for sophisticated users to asymmetrically target unsophisticated users, all while simultaneously forcing market manipulation, cannot be justified as equitable.

Side features of the “last traded fair price” settlement that are equal nightmares, albeit less central to the core issue, include timing (what specific time is used as a reference) and source (basically every league has multiple methods for communicating a void scenario).

If the US Open tweets that Sinner is withdrawing but he has not yet been posted to the website as withdrawn, has he?

This simply cannot be the answer.

Don’t Present Problems, Present Solutions

As someone who frequently complains I have found benefit in occasionally showing up to the table with solutions. In this case the solution is both natural and easily executed.

Every player prop with a yes/no/over/under market either happens, or it doesn’t. If Cole Kmet does not play in the Bears next game, he will not score a touchdown (he probably won’t if he does, either, given Caleb William’s propensity to overthrow). If SGA does not play in the Thunder’s home opener, he will not go over his points line. Thankfully, as player props offer uniquely binary outcomes, there is a clear method of settlement that can be used regardless of whether the player is ruled out, withdraws, or does not participate in the event. Player props must be settled at 100 cents or 0 cents.

Why This Is Not Just Less Bad, But Actually Good

Before I address the main criticism of this settlement method, I think it would be refreshing to highlight the benefits.

The ability to trade a concept (player to not play) that is unavailable at regulated sportsbooks

Enhanced information/price discovery

Retail users are unlikely to be asymmetrically hurt by this policy

As Kalshi works hard to reinvent culturally appropriate dinner conversations, it may start with markets that actually are discussed more amicably around the table. Players’ propensity to sit, or likelihood to start, are frequent topics of discussion among casual sports fans and avid bettors alike. The opportunity to wager directly on such outcomes is novel, with the added benefit of holding a position regardless of whether the initial start/sit intuition was correct. Further, this is straightforward for retail customers who, with appropriate and highly visible disclaimers, should understand the market in which they are trading and how it will be settled.

Why the Downsides Aren’t Really Downsides

I can already hear the shouting. “No market maker will want to offer liquidity in markets that can be so easily won with information” or, for those who prefer less words, “adverse selection!!!”

While this approach may increase adverse selection risk for market makers, it creates a far more transparent and fair experience for retail traders — which should be Kalshi’s priority as it grows. Further, transparent price discovery, albeit at a cost, is a benefit to the market makers as well as it enables further alpha generation on correlated markets.

Say for a moment, in a world in which props settle at 100/0 cents, you have knowledge that SGA will not play the Thunder home opener. This news has not yet made it in market.

If you are trading at real size the first places you will click are likely not an exchange.

By the point in which you do make it to Kalshi, you are clicking the spread and Moneyline for as much as you can get.

The market maker sees this fill and, assuming competence, moves props in a corollary manner or reduces derivative liquidity.

If you are trading only props, what do you click first? Certainly not SGA, as wiping SGA liquidity will, assuming competence, result in an upward revision of his teammates lines to reflect the diminished likelihood of SGA performance. In practice, an individual with this information is likely to bet Jalen Williams, Chet, Hartenstein, and Caruso overs before they even make it to an SGA click, as this maximizes returns. Again, assuming competence, the change in fair market value for each of SGA’s teammates props should lead to a revision in the market makers’ provided liquidity and pricing for SGA props.

Sportsbooks and market makers already do this; this is not some fundamental change to current operating methodology. Inputs (wagers) revise their models, driving continuous pricing revisions to reflect the impact market forces on the underlying sims. In fact, sportsbooks & exchange that profile customers are often able to determine whether SGA will play before the market catches up as a result of the action they are taking. As such entities begin/continue to plug into exchanges, liquidity that exists as a result of uncertainty is likely to be replaced by liquidity that can price such uncertainty.

To take a step back from the inner workings if market makers, the latter scenario in which a trader maximizes EV through trading non-SGA props first is already happening in market. Settling SGA under at 100 cents is unlikely to meaningfully change the behaviors of bettors at all, with the added benefit of market makers gaining information through price discovery.

If the argument is that market makers are incentivized to remove liquidity if prop unders are settled at 100 cents in the event players don’t play, but bettors are not incentivized to change their market activity as a result of the change, the argument essentially becomes that market makers are already disincentivized to provide liquidity in prop markets. Given existing volume, this clearly isn’t true.

The Downsides Are Also… Illegal!

Trading on insider information is illegal. To the extent Kalshi can eliminate trading on non-public insider information (they can’t) or go after the worst actors (they can) then market makers are further insulated from a downside scenario. The downside scenario of course being toxic, yet valuable, order flow.

Kalshi has an opportunity to lead the industry by creating clear, fair rules that align trader incentives with the health of the exchange. By transitioning away from last traded fair price settlement they can eliminate forced manipulation, protect retail users, and build trust in prediction markets. Anything less risks eroding the very foundation of their platform.

**** the end ****

With the serious business out of the way, let’s take a lighter look at our only recurring segment: delusional tweets of the week that was.

THIS WEEK IN DELUSIONAL PREDICTION MARKETS TWITTER

Prediction markets will be bigger than NASDAQ

One trades Tesla deliveries, the other trades Tesla itself.

Prediction markets optimized for truth

If the truth is “Nick Castellanos does not perform better on days of tragedy” then yes, I guess so. The endgame of betting is “information discovery” in the same way the endgame of studying with your high school girlfriend is “learning” — it’s not (and both parties are actively trying to fuck each other).

Insider trading is still a feature, not a bug

Sighs in “most commissions have more than one member” … maybe one day CFTC. As an aside, if one-man commissions are now in I hereby declare this the Commission on Regulating Stupid Prediction Market Tweets (CRSPM).

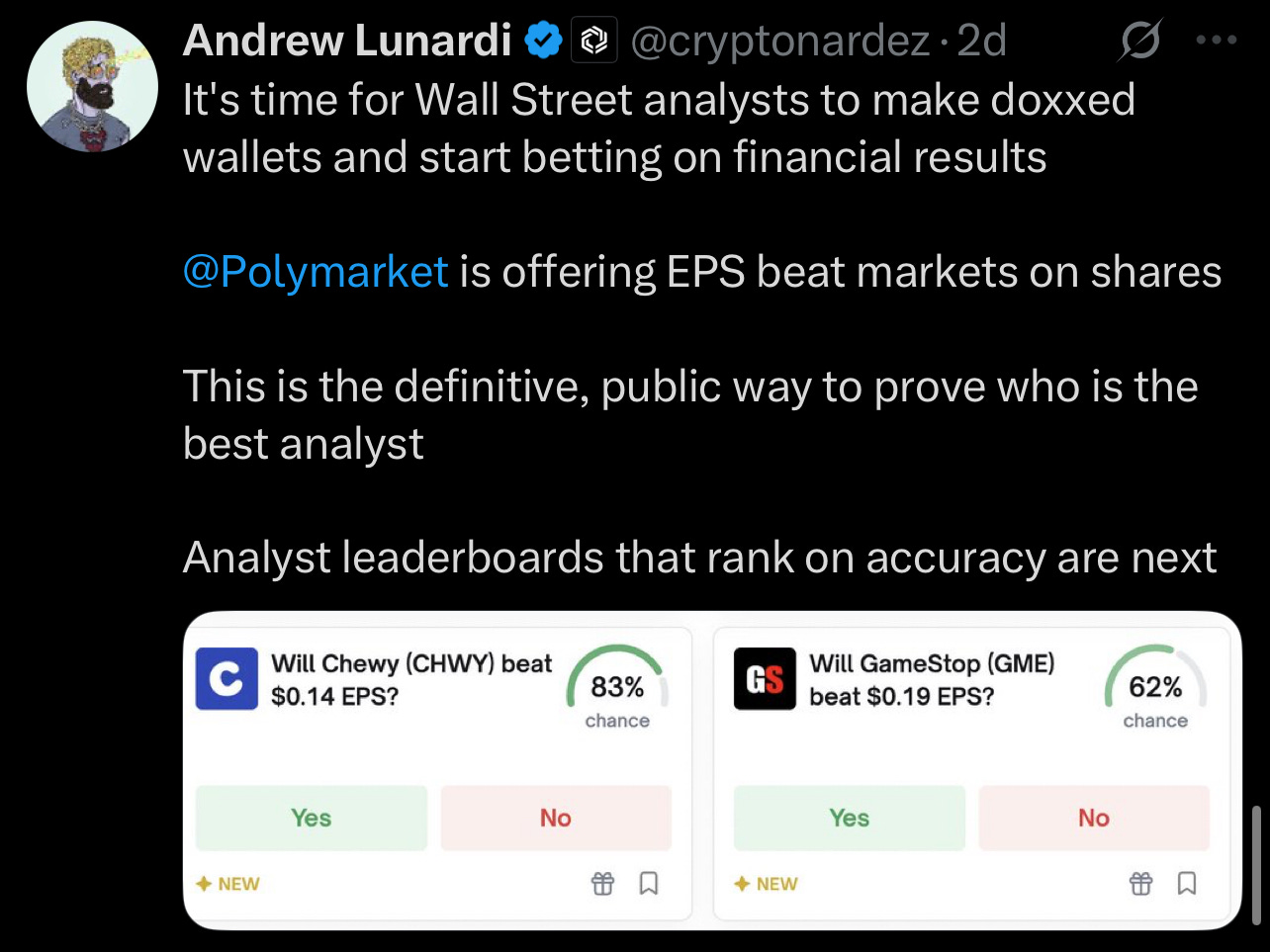

Sell-side analysts should start betting

Lot to unpack here. First and foremost, this dude definitely thinks strippers actually love him, no ulterior motives. Setting aside the clear misunderstanding of the job, we have a frontrunner for “most likely to be insider traded” market of the year.

Your Day Job

My day job is actually slinging burgers, but props to Kalshi for allowing me to forgo trading against SIG’s algorithms in equities and instead trade against … SIG’s algorithms in sports.

New Trading Strategy Unlocked

What happens when Philly doesn’t score the next touchdown Easy, what happens then? It’s always nice to see logical fallacies from one niche move into another, as we are blessed with the ‘ol “i’ll bet one team and then take the other team when they score” as it makes its transition from OSB to PM’s.

Kalshi is not winning because of a US License

Correct, they are winning because of a US license AND Robinhood. Congratulations to the Kalshi team on their first parlay!

These damn Harvard kids

I asked my four year old nephew his thoughts on rising tension between the US and China and he nodded vigorously before launching into a diatribe on China’s Belt and Road initiative. Both conversations 100% definitely happened as described.

The new meta

But what if the people believe the opposite but think you will think the opposite. What happens then, huh? This makes my brain hurt in “doesn’t understand EMH” manners indescribable to man.

Excellent post! Your settlement solution sounds workable and sensible to me (very much a retail trader).

Even if you don't keep up the weekly in-depth analysis, your Delusional Twitter Takes are gold.

Good post.

If you don’t have a live kalshi ticker at your thanksgiving dinner table this year you’re ngmi. higher.